The True Cost of Multi-Tenancy: A TCO Analysis That CTOs Actually Need

by Jinoy Patel

Table of Contents

Your finance guy just walked up to your cubicle with that look. You know the one, the same expression they wore when they discovered the company was spending $50,000 annually on a "collaborative whiteboard solution" that three people used. They've been crunching numbers on your infrastructure costs, and they want answers.

If you've been in this industry long enough to remember when Docker was just a weird idea and everyone thought the cloud was just marketing fluff, you know this moment well. It's the classic single-tenant to multi-tenant conversation, and it always starts with someone looking at infrastructure costs and thinking they've discovered a money-printing machine.

They're not wrong about the potential savings. But they're not seeing the full picture either. Multi-tenancy isn't just about splitting server costs; it's about changing how you think about Total Cost of Ownership (TCO).

The True TCO Comparison: 5-Year Analysis

Let me walk you through a realistic scenario based on companies I've worked with. Imagine you're a B2B SaaS company with 200 customers, growing at 20% annually, with average revenue per customer of $5,000/year.

Single-Tenant TCO (5-Year)

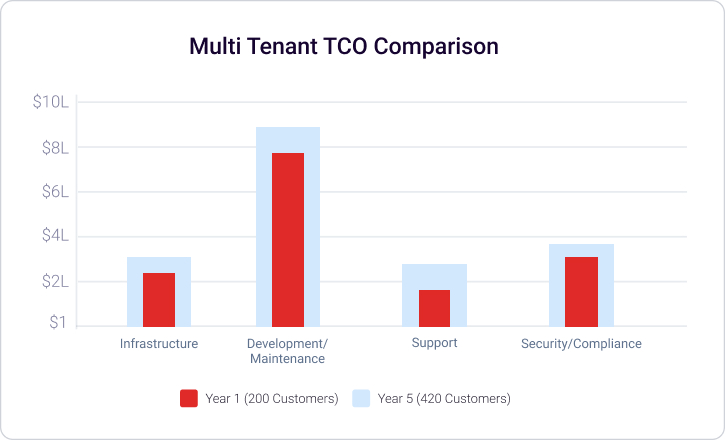

Multi-Tenant TCO (5-Year)

When we look at Total Cost of Ownership, the gap between single-tenant and multi-tenant becomes very clear.

In the single-tenant model, the cost of operations more than doubles between Year 1 and Year 5, rising from $1.5M to over $3.1M. This means that as the customer base grows, costs scale almost linearly. Every new customer adds pressure on infrastructure, development, support, and compliance. The growth in revenue risks being offset by the growth in operating costs.

The multi-tenant model tells a different story. Costs grow only modestly, moving from $1.48M in Year 1 to $1.88M in Year 5. That’s a relatively small increase compared to the expansion in customer base. The ability to share infrastructure, streamline support, and reduce duplicate compliance efforts keeps the overall TCO under control.

The multi-tenant approach saves approximately $4.4 million over five years – a 34% reduction in TCO. But notice the pattern: higher initial investment, dramatically better scaling economics.

For business leaders, the takeaway is simple: a multi-tenant approach drives long-term cost efficiency. It keeps operating costs predictable while still allowing customer growth. Instead of watching expenses double, you’re able to scale in a way that protects margins and improves overall return on investment.

The Operational Excellence Framework

Successful multi-tenant implementations require operational capabilities that most single-tenant organizations don't have. Let's break down the four pillars that determine whether your multi-tenant investment pays off.

Automated Tenant Lifecycle Management

In single-tenant world, provisioning a new customer might take hours or days. In multi-tenant world, it should take minutes. But this requires sophisticated automation that can handle tenant creation, configuration, and teardown without human intervention.

The operational efficiency gains are dramatic. Companies with mature tenant lifecycle automation report 90% reduction in onboarding time and 70% reduction in offboarding effort.

Centralized Observability

Multi-tenant monitoring is about understanding tenant behaviour, resource utilization, and performance isolation. You need visibility into both system-level metrics and tenant-specific patterns.

The key insight: in multi-tenant environments, correlation is everything. When performance degrades, you need to quickly identify whether it's a system issue or a tenant-specific problem.

Deployment Orchestration

Deploying to a multi-tenant environment is like performing surgery on a patient who's awake and running a marathon. Everything needs to keep working, nothing can be interrupted, and any mistake affects everyone.

Successful multi-tenant deployments require canary release processes, feature flags, and rollback capabilities that understand tenant isolation. The operational investment is significant, but the scaling benefits are enormous.

Security and Compliance Automation

Multi-tenant security grows smoothly with your user base, preserving strict isolation for every tenant. This requires automated security scanning, compliance monitoring, and audit trail generation that works across all tenants.

When Multi-Tenancy Makes Sense

The TCO analysis I've outlined shows clear financial benefits, but multi-tenancy isn't always the right choice. Here's my framework for making the decision

Choose multi-tenancy when

- You have 50+ customers or plan to scale beyond 100

- Your customers have similar functional requirements

- You can invest 6-12 months in upfront architectural work

- Your team has experience with distributed systems

- Compliance requirements are consistent across customers

Stick with single tenant when

- You have customers with highly specialized requirements

- Regulatory requirements vary significantly by customer

- You have limited development resources

- Customer count is unlikely to exceed 50

The Path Forward: Implementation Strategy

If your TCO analysis points toward multi-tenancy, the implementation strategy matters as much as the architecture. Here's the approach we recommend

Phase 1: Foundation

- Build tenant isolation framework

- Implement basic monitoring and logging

- Create tenant provisioning automation

- Establish security and compliance baseline

Phase 2: Migration

- Migrate pilot customers

- Refine operational processes

- Build deployment automation

- Validate performance isolation

Phase 3: Scale

- Migrate remaining customers

- Optimize resource utilization

- Implement advanced monitoring

- Establish operational excellence metrics

How Aakash Can Help

The TCO benefits of multi-tenancy are clear, but the implementation complexity is real. At Aakash, we've helped multiple platforms navigate this transition successfully, and we understand that every organization faces unique challenges.

Our approach focuses on minimizing risk while maximizing the economic benefits of multi-tenancy while building the operational capabilities that make them profitable.

Our Multi-Tenant Expertise

- Architecture Design: We help you choose the right multi-tenant patterns for your specific requirements and constraints

- Migration Planning: We develop phased migration strategies that minimize disruption to your existing customers

- Operational Excellence: We build the monitoring, deployment, and management systems that make multi-tenancy scalable

- Security and Compliance: We implement tenant isolation and security controls that meet your industry's requirements

What Sets Us Apart

- TCO Focus: We understand that multi-tenancy is ultimately about business outcomes, not just technical architecture

- Operational Maturity: We've seen the failure modes and know how to avoid them

- Industry Experience: We understand the compliance and security requirements in regulated industries

- Partnership Approach: We work with your team to build internal capabilities, not just deliver projects

We believe that successful multi-tenant implementations require more than just good architecture – they require operational understanding, business accumen, and strategic thinking. Whether you're evaluating the move to multi-tenancy or optimizing an existing multi-tenant platform, we can help you achieve the TCO benefits while avoiding the common pitfalls.

Ready to realise the economic advantages of multi-tenancy? Let's start with a conversation with our team to know more.

Learn how we can accelerate your business.

We build and deliver software solutions. From startups to fortune 500 enterprises.

Get In Touch